Why Remain Invested in a War Zone

While the war in Ukraine had started disturbing the portfolio by late February, it disturbed me personally on March 4, 2022. Darek J, a contractor from Krakow, Poland (Chicago has the 2nd largest Polish population in the world), who was working on my kitchen, showed me a disturbing video he had received from his friends.

The minute-long video showed a Russian tank rolling down the street, presumably in Ukraine, while a few cars moved about in both directions. A few seconds later, the tank pauses and lurches left towards a car going in the opposite direction, crushing it, just like in a violent video game, except here in the background the women shooting this video from an apartment complex scream in terror. A few more seconds later, the tank backs out, leaving a crushed piece of metal, and just drives by. If you have not watched it, please don’t. I started to write this note that day, but with emotions running hot, I decided to take my time.

As distressing as it is to watch a belligerent force (Russia) militarily attack a sovereign nation (Ukraine) and upend the lives of innocent people, based on historical facts we should not be surprised by this inhuman act. “War is one of the constants of history, and has not diminished with civilization or history. In the last 3,421 years of recorded history only 268 have seen no war,” [emphasis mine] say Will and Ariel Durant in their book The Lessons of History. History notwithstanding, markets, particularly in Europe, were still surprised at the onset of this war, leading to increased volatility in stock and currency markets.

Before I get started, let me make it clear that we are NOT invested in either Russia or Ukraine. I am referring to Poland (with two of our 11 investments), which is our biggest country exposure outside of the US, and which I categorize as being in the “war zone” broadly speaking. In this note, I will cover the following:

Why remain invested in Poland?

Our investments in Poland: Dino Polska S.A. (DNP) and LiveChat Software S.A. (LVC)

Why not hedge the currency risk?

Why remain invested in Poland?

I made our investments in Poland in 2020 (LVC) and 2021 (DNP), well before any sign of military aggression. But now that a belligerent force has arrived on its border, what now? I believe Poland is still an attractive market and the two businesses we have there, which I will talk about next, are in a good position to handle the current situation.

Poland, the European Union’s biggest economy outside the euro region, and other Baltic states have felt the most pressure stemming from this invasion. Kasper Elmgreen, head of equities at Amundi, an asset manager in Dublin, said, “You can draw a correlation map between the proximity to the conflict areas and market impact.”

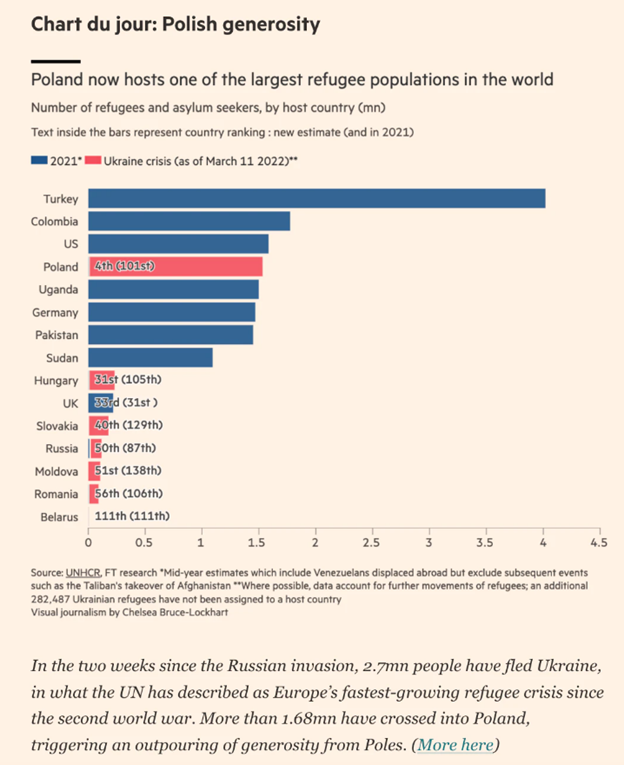

By early March, Poland WIG, an index of Polish stocks, had dropped by 11% since January 1, 2022, and it was a similar story across much of Europe. Both the outflow of European equity funds and inflow of refugees from Ukraine into Poland have smashed records since.

Within less than two months after the Russian invasion of Ukraine, the Polish population has swelled by ~5%. Poland now hosts one of the largest refugee populations in the world.

Also, the currency markets showed visible signs of stress—Polish zloty depreciated by ~15% within days of this war beginning. Adam Glapinski, the head of Poland’s central bank, criticized the “stupid wave of panic” and said, “These people are watching too much of the internet…especially, the young, educated in big cities…Poland is an absolutely safe country.” The zloty has recovered some of its losses and is currently in the range of PLN 4.20 - 4.25 to $1.00.

So, where is the silver lining for Poland? Michael Kranz in Foreign Policy Magazine says of Poland, “As both a target and vocal opponent of Russian ambitions, NATO’s largest member in Eastern Europe is positioned to play a crucial role in Europe’s security relationship with Russia and become the linchpin of Western efforts to project power in Eastern Europe [emphasis mine].”

After a COVID-induced recession in 2020 (the first since 1980), the country is back to growing its economy and is expected to grow 5.5% in 2022, according to the European Commission. Inflation and pricier commodities have forced the central bank to raise interest rates and intervene to support their currencies. Poland is a NATO member, is now the mainstay of western efforts attracting capital and other resources, has a strong balance sheet with more than $158 billion in foreign exchange reserves and only 47% of GDP in government debt (compared to Italy’s 133%, France’s 99%, and Germany’s 57%), and with a further-declining unemployment rate of 2.9%…I tend to agree with Adam Glapinski.

An important question is, will the war extend beyond Ukraine to, say, Poland? Depending upon who you ask and when, the likelihood of such an event appears low. As Barry Pavel et al. say in The Atlanticist magazine:

Early evidence suggests that this war is turning in the West’s favor…Wars, once begun, rarely follow a script. More frequently, they lead combatants and non-combatants alike down unanticipated pathways, with occasionally world-changing results. Russia’s invasion of Ukraine appears to have the seeds of such a conflict. What its outcome will mean for Ukraine and the world remains to be seen.

Our investments in Poland: Dino Polska S.A. (DNP) and LiveChat Software S.A. (LVC)

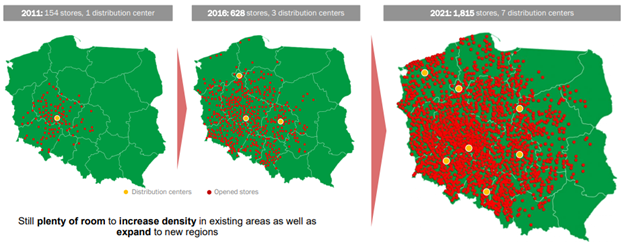

DNP is the fastest-growing food retailer in Poland. In September 2021, I wrote about DNP, which you can access here. LVC is a customer service application facilitating quick contact between clients and companies through a chat application embedded in the companies’ websites.

Both DNP and LVC announced their 2021 results in March, well after the Russian aggression started in Ukraine. While it is early days of war, both management teams expressed their concern for the innocent people of Ukraine but reassured their shareholders that there have not been any operational issues stemming from the war.

First, DNP (YTD: -8.0%), the food retailer. The two most important drivers of any retailer are:

same-store sales or like-for-like sales; and

new store growth.

Same-store sales (SSS): SSS, or, as they like to say in Europe, like-for-like (LFL) sales, is an important indicator of growth. A positive LFL sales means that the company generated more sales per store compared to the previous period—an indicator of customer demand. LFL sales in turn are driven by two factors—the number of customers walking into the stores and the average price per customer order.

Since inflation has been hot in Poland for a while, generating a high LFL sales relative to inflation is a good indicator of operating health. DNP has consistently generated healthy LFL sales and in 2021 did 12.4% vs. 3.2% in food inflation. I expect DNP to continue to generate healthy LFL sales in the future.

While inflation is a tapeworm that troubles both consumers and businesses, it disproportionately troubles those businesses that are not able to pass on the added cost. While inflation is a problem in the near term for most businesses, food retailers are in a slightly better position to pass on the cost as the items need to be replenished or substituted as they are consumed. With many Polish families generously accepting Ukrainian refugees who need to be fed, I expect DNP (and many of its peers) to help in the cause and eventually benefit from it.

One of DNP’s strategies is to own the land on which its stores sit which happen to be in rural and smaller towns of Poland. This is in contrast to many of its competitors who lease the land and retail space in urban areas. During inflationary periods, lease rates increase, hurting their bottom line. The strength of owning the land and not incurring a rising lease rate is evident in DNP’s healthy operating leverage (CAGR of revenue since 2014 of 30% vs. CAGR of operating income since 2014 of 38%); as revenue increases, operating income increases even more.

New store growth: In the March 2022 earnings call, the CFO said that the war has not slowed down their expansion plans. Consistent with its plan and historical growth, DNP grew its store base by 23% in 2021 to 1,815. In Q1 2022, it added another 66 new stores. CAGR of stores from 2010 is 25.5%. It is well on its way to having more than 2,200 stores by the end of 2022 and more than 3,000 by 2025. Poland shares its eastern border with Ukraine (and Belarus). While it is too early to tell how many Ukrainians will stay in Poland and, if they did, where they will settle, some retail experts believe that many would prefer the eastern provinces of Poland. This would play well into DNP’s strategy of expanding in the east, where it has the fewest number of stores.

I continue to believe that DNP is a terrific long-term opportunity because it has: limited competition in rural and small towns of Poland; a unique strategy of reinvesting 100% of the cash from operations back into the business for store growth; and a significant opportunity to grow its footprint.

Next is LVC (YTD: -13.9%), the customer service app. It is the communication tool that you may see pop up when you visit certain websites asking, “How may I assist you?” or “How may I direct your query?” The application is mainly used for customer service and online sales.

LVC has more than 34,500 clients in more than 150 countries, but its highest revenue contribution comes from North America and the UK. It generates only 2.0% of its revenue from Poland and barely 0.5% of its business from Russia and Ukraine. The war has not had any direct impact on its business.

Wage inflation, particularly wages for software engineers, has been a headwind for more than a year. In fact, IT wage inflation has been a global phenomenon over the last year, and it continues to be so.

While software wage inflation is the tapeworm affecting the margins of most software companies, LVC enjoys a distinct advantage from the current currency turmoil. 100% of its revenues are in USD; LVC requires all its customers to pay in USD, irrespective of where they are located. At the same time, since most of its employees are in Poland, more than 50% of its expenses are in Polish zloty. Payments for infrastructure and data storage are paid in USD, which accounts for the balance. This actually leads to a favorable situation when the company translates its USD revenue to Polish zloty. When I started investing in LVC in 2020, the exchange rate was ~4.0 PLN = 1 USD. After hitting PLN 4.60/USD, it has settled around 4.25 PLN. I suspect the currency will remain volatile as long as the refugee situation continues.

I remain invested because my original thesis for our investment in LVC still holds. The company continues to grow its customer base, which is now more than 34,500 spread across 150 countries, monthly recurring revenue (MRR), which is the best indicator of growth, continues to improve at a healthy pace—$2.5 mill in March 2019 to $4.6 mill in March 2022. The company is still run by the founders, who own ~40% of the shares outstanding, with no debt on the balance sheet, and it is trading at a reasonable valuation. Management returns almost all of the free cash flow (FCF) back to shareholders as dividends which yield 3.8% at current price.

Why not hedge the currency risk?

As the war broke out, stock prices wobbled, as did the currencies. In an unhedged global portfolio, this produced a double whammy of both stock prices and currencies declining in tandem. So, it’s a reasonable question as to why I don’t hedge the currency risk. Some of the reasons are below.

Since it is almost impossible to predict the timing of currency movements, I believe that, as long-term investors, we should not base our investment decisions on future currency movements.

Foreign exchange rates are hardly static. While exchange rates fluctuate in the short term, the impact of currency on investment returns tends to decline over time.

While neither DNP nor LVC hedge their currency exposures, many of our portfolio companies do on their own. Therefore, hedging our exposure could be redundant.

Hedging currency exposure is expensive and can introduce leverage to the portfolio.

In any given year, a currency hedge is just as likely to hurt as it is to help, particularly with a currency like the zloty, which has had an established history of stability relative to the USD over the past decade.

I expect the natural hedge of being exposed to different currencies to even out any currency movements over time. While macro events like this often have an undeniably powerful effect in the short term, what matters over the long term is: a company’s ability to generate healthy return on capital; reinvestment opportunities; honest and competent management teams with skin in the game; and reasonable valuation.

To summarize, Poland, with its NATO membership and strong sovereign standing, is “an absolutely safe country.” Both DNP and LVC have unique strengths that make them an attractive investment for the long term. Finally, hedging currency risk may, at best, protect from short-term swings only.

Thank you for reading.