Evolution: The Leader in Live Casino

My preference for high-quality businesses that can grow their intrinsic value at high rates over a long-time horizon has led me to Sweden recently. One of the companies that I had been tracking for a while was NetEnt AB, a Swedish online gaming company with a big share of online slots in the US. In the middle of 2021, as the pandemic was raging, the company announced that it would be acquired by its Swedish competitor, Evolution[1]. My interest in Evolution (OM:EVO) was piqued. Thanks to my friend Johannes Arnold, who is a long-term owner of the stock for Nordstern Capital in New York, for helping me with due diligence. EVO, founded in 2006 (IPO in 2015)[2] and based in Stockholm, Sweden, is a recent addition to the portfolio. In this note I’ll provide some color about the business and why we own it.

1. What does Evolution do? EVO is an online Business-to-Business (B2B) casino supplier focused on the “live” vertical, with more than 300 customers around the world. The company develops, produces, markets and licenses fully integrated Live Casino solutions to gaming operators. In Live Casino, a game presenter (i.e., dealer) runs the game from a casino gaming table that is followed in real time via a video stream. End users (i.e., the players) make betting decisions on their devices (computers, smartphones, tablets, etc.).

EVO provides the picks and shovels to the operators! As Peter Lynch said, “During the Gold Rush, most would-be miners lost money, but people who sold them picks, shovels, tents, and blue-jeans made a nice profit.” EVO provides all aspects required by a gaming operator, from the recruitment and training of game presenters and other staff to streaming, production, supervision, customer services, and follow-up. These games are hosted by EVO on the customers’ (iGaming operators’) sites. Operators are offered a fully customized white-label solution. The company has a broad portfolio of core games including both classic table games and new innovative casino games (e.g., from Live Roulette and Blackjack, to “Dreamcatcher” and, more recently, “Crazy Time”). EVO earns a commission of ~10% to 20% on gross gaming revenue (the operator’s customer losses) generated from its games.

The company has livestreaming online casino studios in Riga, Latvia, Tbilisi, Georgia, and Fort Mriehel, Malta. In addition, it has studios in New Jersey and Pennsylvania in the US (with a Michigan studio to open likely in July 2021) and Vancouver, Canada. It also runs on-premises studios on land-based casinos in Belgium, Romania, Spain, and the UK.

So, that’s a basic summary of the business. In the following pages, I’ll show how and why I believe Evolution fits my definition of quality—which is a function of both competitive advantage and growth. In fact, I like to describe the investment philosophy of SVN Capital as a value-oriented fund with a heavy “quality” overlay. EVO fits that definition perfectly.

2. What is the quality of this business? According to H2 Gambling Capital (H2GC), a UK-based gambling industry data provider, more than 80% of global gambling revenue (i.e., customer losses) is expected to come from land-based casinos. Approximately €16 bill. of gambling revenue is expected from online casinos.

Share of different games and markets:

Gambling is a huge market with estimated gross winnings of €307 bill. Online gambling is growing at a much faster clip (12% CAGR from 2016 to 2019) than land-based gambling (2% CAGR from 2016 to 2019). Live Casino, historically EVO’s focus, is growing the fastest (32% CAGR from 2016 to 2019) within online gambling. EVO has grown its revenue, mostly organically, at 49% from 2016 to 2020!

Some of the reasons for online casinos’ strong growth are:

Scale advantage – unlike on a land-based casino table where only a few people play at any one time, thousands of players from around the world play at the same time on an online casino table;

Increasing market regulation – contrary to many other industries, regulation attracts more operators and players;

Internet penetration and bandwidth capacity – since Live Casino requires high-quality video production and internet streaming capacity, until recently, this technology constraint delayed its growth; and

Confidence in online payment solutions and mobile capacity. Also, Live Casino is seen as more engaging and trustworthy than graphical random number generator games like slots.

So, what accounts for EVO’s meteoric growth rate? First, it is the company’s ability to offer a variety of games—both traditional casino games and games based on game shows. A typical casino would offer games such as roulette, baccarat, blackjack, craps, poker, and other card games in addition to slot machines. EVO has been at the forefront of this transition to online gaming and has been supplying these games with “Live Casino” content. While EVO continues to be a market leader in transitioning many of these traditional casino games into the Live Casino content, it took a giant step in differentiating itself from its competition with the hiring of Todd Haushalter as chief product officer.

Prior to joining EVO, Todd was responsible for traditional games at Bellagio in Las Vegas, a traditional land-based casino. Admittedly, he took a major risk by leaving Bellagio to go work in Europe for a small gaming company that was trying to tie technology to traditional casino games. He has not only had an impact on the company, but also on the Live Casino industry. Thankfully, he’s a bit more public than the rest of the team and has given some interesting interviews about the company and industry. Here’s one: https://www.youtube.com/watch?v=L7B7ibU41i0.

Here’s another one where he goes into great detail about everything gaming. One of the fascinating comments he makes repeatedly is, “We spend a lot of time thinking about players we don’t have.” This mindset allows him and his team to create more desirable products, which leads to increased total addressable market (TAM): https://www.youtube.com/watch?v=peGmpsai66M.

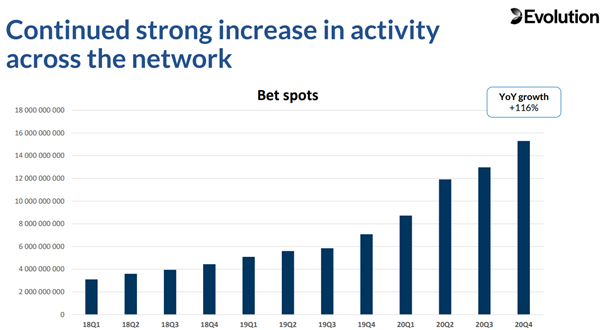

Since 2012, EVO has launched 27 new games. Beginning in 2017, the company started introducing its own games (Dream Catcher in 2017, Monopoly Live in 2019, Crazy Times in 2020), as well as TV game shows in a live format (Deal or No Deal in 2019). The popularity of these games is not only evident in the growth of operators that have signed up with EVO (from 70 customers in 2014 to more than 300 by 2020), but also in the total number of bets being placed throughout all the games being offered by EVO. While creating its own games is a differentiating factor, its ability to execute flawlessly puts considerable distance between EVO and its competitors. A statement that Martin Carlesund (CEO) makes at every opportunity is, “While barriers to entry are relatively low, the barriers to success are considerably high.”

EVO introduced 12 new games in 2020 and has similar ambitions for 2021 and beyond. This product development cycle is a key differentiating factor in providing shareholder value.

Another reason for the company’s success is RTP. Return to Player (RTP) is what a game will pay players over time. Assume 100,000 players visit an online casino and each one stakes $1.00 on a game, making $100,000 in total bets. If all the winnings received by the players total $96,000, then the RTP for that game is 96%. RTP is also what induces players to spend time and money playing these games. All casino games, both land based and online, have a built-in advantage that favors the house. This advantage is called the “house edge.” RTP for online games typically is in the mid-to-high 90%, while for land-based casinos it is 70% to 90%, primarily because these brick-and-mortar casinos need to pay for fixed costs.

Games need to be interesting enough for players, as well as pay well for the operator (house). Top Live Casino, a site that tracks such information, lists games with the highest and lowest RTP:

On EVO-offered traditional casino games, RTP is high, while on EVO-developed game show games, RTP is low, allowing EVO to collect the cost of developing such games. Todd Haushalter said that Crazy Time, released in 2020, was the most expensive game ever developed.

So, who are EVO’s customers, and how does the company get paid? Online casinos and gaming providers like DraftKings, GVC Holdings, William Hill, and 300 other such providers are its customers. These operators typically sign a three-year contract. The most basic agreements normally include access to livestreaming generic tables, while more complex agreements can include dedicated tables and environments, VIP services, native-speaking dealers, and other customizations to produce a Live Casino experience that is as unique as possible for the end user and helps the operator stand out from the crowd.

The majority of EVO’s revenues consists of commission fees (~10% to 20% of gross winnings) and fixed fees for dedicated tables, which are paid monthly by operators. Commission is calculated as a percentage of the operators’ winnings generated via the company’s Live Casino offering.

So, how profitable is the operation? EVO benefits from network effects; as the company releases more attractive games and signs up operators, more players participate, leading to better margins.

Since going public in 2015, the CAGR of revenue is approximately 50%. As the following chart shows, such revenue growth has led to better margins.

EVO’s biggest cost is staff cost. It currently has ~8,700 employees, about 90% of whom are dealers located in its studios in Malta, Latvia, Georgia, and North America.

The company has always been run with no debt on the balance sheet. Free cash flow (FCF) has grown from €12 mill in 2015 to €294 mill in 2020. Also, FCF conversion (of net income), on average, is about 90%. Five-year average after-tax operating earnings/tangible assets are about 41.5%. The average ROIC since going public in 2015 has been 27.5%. In other words, the business has been highly profitable and efficient.

Europe, with better internet connectivity and gaming regulations, has historically been the biggest market.

Why Malta? Some Americans may wonder what Malta is and may think that it’s an energy drink! Malta is a small island nation in the Mediterranean, located a little south of Italy. Malta is part of the EU and offered a global gambling license. With a Malta Gaming Authority (MGA) license one could operate in all EU countries. This is one of the reasons why the entire gaming industry is on the island, although it is changing now with regulations everywhere. Just as Bermuda in the Atlantic has become the global center for reinsurance companies, Malta has become the global center for online gambling companies. In addition, the country offers a tax-advantaged infrastructure for online gaming companies. While EVO started its operations in Cypress, which also offered a global EU gambling license, the company has expanded to Malta, Latvia, and Georgia.

How about profitability in the future? As the chart on page two shows, barely 20% of global gaming revenue is from online providers; about 80% is from land-based casinos. While land-based casinos will continue to survive—and some of them may thrive—many serious gamers would love to avoid smoke-filled halls and noisy tables. So, I expect the trend of online gaming growing at double-digit rates (and Live Casino growing the fastest) to continue. While this trend has been accelerated by COVID, I expect some of this behavior to stick even after economies open up.

Regulation is another important driver of online casino business. As states/countries impose regulations, more operators and players gain confidence and participate in such markets. Given the tattered state of budgets in many states and countries, legislators/regulators are likely to impose regulations and expand their tax web.

Europe has been a leader in connectivity and regulations. Approximately 60% of global gross gaming revenue (GGR) comes from Europe, where EVO has about 60% market share. GGR is expected to grow less than 10%. I expect EVO to continue to dominate the market.

North America, particularly the US, has been slow with internet connectivity and regulation. Only five states currently regulate online casinos (Delaware and New Jersey since 2013, Pennsylvania since 2019, and West Virginia and Michigan since 2020). EVO has studios operating in both New Jersey and Pennsylvania, and expects to open a studio in Michigan by mid-year 2021. These five states account for 11% of the 225 adult US populations with estimated online casino market sizes of €1.3 bill., which is estimated to almost double to €2.3 bill. by 2025.

Following the success of sports betting and pot regulations, combined with the shift in attitudes of land-based casinos to embrace online gaming, I expect more states to regulate. Currently, there are proposed legislations in New York, Massachusetts, Virginia, Connecticut, and Kentucky.

Flutter Entertainment (ISE:FLTR), an Ireland-based iGaming company, recently pointed to $1.3 bill. (€1.1 bill.) iGaming TAM for every 5% of regulated US population, implying a fully regulated TAM of $26 bill. (€21 bill.) at maturity by 2025. Currently, EVO is the only major live casino provider in the US. UK-based Playtech plc (LSE:PTEC) is expected to enter the US. The US remains a significant market opportunity for EVO and its peers.

Asia is a big and fast-growing market; much of the region remains either lightly regulated or un-regulated. The land-based casino market is €46 bill., which is 5x that of Europe, second only to North America; but there is a low online penetration of just 5% (Europe 46%). H2GC estimates the Asia market to be €2.2 bill., which is only 1/4th that of Europe. This may actually understate the true size of the market, as much of Asia remains unregulated. Europe took about 15 years to move from a 6% online share of casinos to its current size of almost 50%. At that pace, Asia can be as big as €35 bill.

In summary, there is a significant runway for EVO.

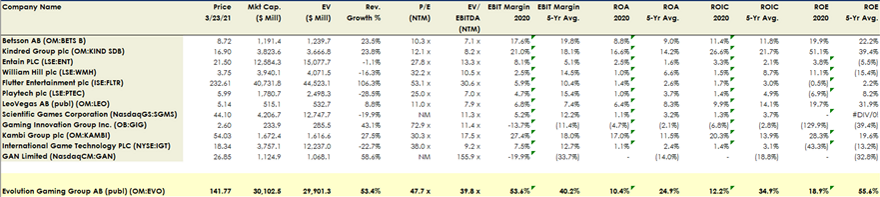

What about competition? After all, with such juicy returns, it’s only natural that competition steps in to arbitrage away the opportunity. There are a number of Business-to-Consumer (B2C) and B2B companies, both public and private, that compete with EVO.

But before talking about competitors, I’d like to highlight how the management team views competition. A mantra that CEO Martin Carlesund pronounces at every opportunity is, “…everything we do is about one thing: to expand the gap to competition and strengthen our market leadership.” Also, CPO Todd Haushalter references the big entertainment companies, such as Disney (DIS) and Netflix (NFLX), as competition, in addition to the traditional peers. This mindset has allowed the company to be the first to release game show hits. The level of respect and paranoia with which the company treats its competitors allows it to be a market leader.

In terms of Live Casino, UK-based Playtech is the closest competitor from Europe. Asia Gaming, an online gaming company from Asia, is another big competitor but is private. There is no good comparable public company, although there are a couple of private ones (Pragmatic, in addition to Asia Gaming). I have included a list of companies, somewhat heavy in slots, in the Appendix. None of them compare well to EVO either in terms of growth or in terms of return. In addition, there are a number of private companies from Europe and Asia that compete with EVO, particularly in slots.

3. What is the quality of the management team? Jens Von Bahr and Fredrik Österberg founded the company in 2006. They remain on the board and control ~13% of the outstanding shares. One of the early backers was Richard Livingstone, a British gaming company operator/investor. Richard’s brother Ian sits on the board and controls ~10% of the shares.

The management team has done a great job of finding a niche, developing new games, gathering new customers, and hiring dedicated dealers, while also keeping the balance sheet devoid of debt. However, I’d find fault with the management team on two counts.

The board and management team has a written policy of paying, over time, 50% of its earnings as dividend. While I don’t begrudge collecting dividend, I’d rather have the company reinvest such earnings while it’s able to generate such healthy returns. Interestingly, such a dividend policy seems to be more common across many of the Swedish companies that I have evaluated recently.

The company issued ~30 mill shares (~17% of outstanding shares) to make a €2.4 bill. acquisition of NetEnt AB in November 2020. While it’s a great strategic fit to acquire NetEnt and get immediate exposure to US slot players, I’d have preferred the use of cash over stock. Fortunately, the company has great organic growth opportunities and has used cash in the past to make a few small acquisitions.

In spite of the above, I have a positive opinion about the management team and will continue to scrutinize the management team.

4. What about valuation? FCF per share has grown from €0.05 in 2016 to €1.48 in 2020. With the acquisition of NetEnt AB, adjusted for new shares issued, I expect the company to make €2.33 per share in FCF in 2021. Growth is an important component of EVO’s intrinsic value creation. As I have outlined in the previous pages, I expect healthy growth over the next few years. Based on my expectations, EVO would generate a little more than €30.00 per share in FCF over the next five years. Based on my average cost of €98.00 per share, the stock is currently trading at ~6.00% FCF yield, which I believe is attractive. Obviously, this hinges on the company continuing to grow at a healthy pace.

Another way I think about valuation is: Value Compounding Rate = Reinvestment Rate * Incremental Return. Over the last five years, the value compounding rate for EVO has been ~50%. While that is impressive, can it continue to compound at that rate over the next five years? I believe that it can, and EVO, with its dominant market share and significant growth potential, is trading at a very attractive valuation.

5. What are the risks? First, regulation. While regulation is a positive in the medium-to-longer term, should certain jurisdictions come down hard on regulation, gaming operators’ and EVO’s revenue stream may be hurt in the short term. Based on recent evidence[3], I expect regulations that allow jurisdictions to expand their tax base, as opposed to impeding gaming operators’ businesses.

Second, competition. Given the juicy returns, and particularly the potential of various states within the US to open up to Live Casino, new competition is likely to enter the space. While EVO has successfully “expanded the gap to online competition,” one or more land-based casinos may enter the fray. In fact, MGM made a $9.0 bill. offer to acquire (but then backed off) Entain, a British online gambling company. While such land-based casinos may have the capital to make such acquisitions, I believe “…the barriers to success remain high.”

[1] After completing the acquisition in November 2020, the company changed its name to Evolution.

[2] While EVO trades in Stockholm, Sweden, the company reports its financials in Euro; 1 SEK = 0.0984 Euro; 1 SEK = 0.1164 USD.

[3] As I was putting the finishing touches on this report, I saw that New York has reached a deal to legalize marijuana for recreational use; https://www.wsj.com/articles/new-york-lawmakers-reach-deal-to-legalize-marijuana-11616611018?mod=hp_lead_pos12

Appendix